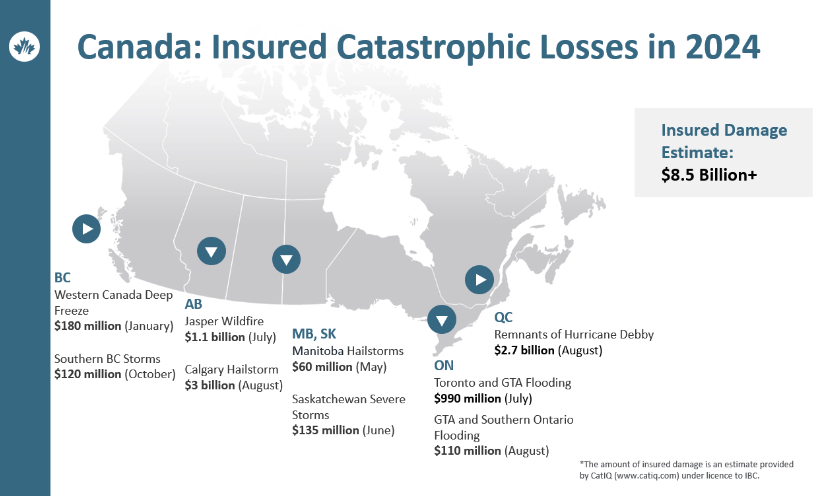

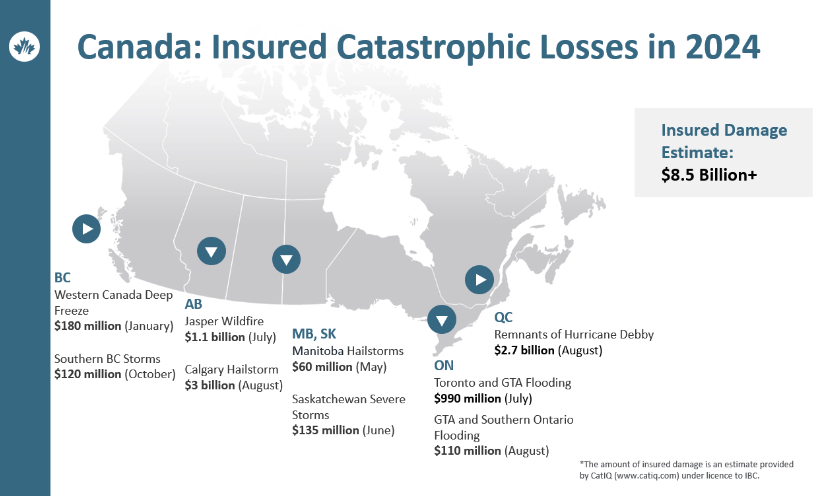

The Insurance Bureau of Canada (IBC) says insured damages caused by severe weather events surpassed $8 billion in 2024.

That shattered the previous record of $6 billion reported in 2016 following the devastating Fort McMurray wildfires.

Last summer stands out as one of the most destructive seasons in Canadian history due to wildfires, floods and hailstorms. According to IBC, in July and August four catastrophic weather events resulted in over $7 billion in insured losses.

“Sadly, beyond the staggering financial losses are hundreds of thousands of Canadians whose lives and livelihoods have been upended,” said Celyeste Power, President and CEO, IBC.

“Canada’s property and casualty insurers have been there every step of the way, and continue to be on the ground, helping their customers rebuild and recover. The industry is doing its part, but it’s time for governments to take decisive action to protect Canadians from these escalating and dangerous events.”

According to the report issued earlier this week, the Calgary hailstorm in August topped the list of most destructive events at $3 billion in insured losses.

The storm brought significant hail, strong winds, heavy rain and localized flooding to the city.

According to the IBC, the hailstorm topped the Jasper wildfire, which caused a staggering total of $1.1 billion in damage in July.

The fire started on July 22 and moved very quickly, leading to a massive, late-night evacuation of the entire township. Four days after the fire roared into the community, officials confirmed that nearly 360 structures were damaged.

Other major losses were seen in Quebec from the remnants of Hurricane Debby ($2.7B), in Toronto and GTA from major flooding in July, which caused $990M in damage, and in BC after it was hit by a cold snap in January.

The cold snap, which caused $180M in damages, devastated communities dependent on farming and orchards in the Southern Interior and led to a massive decline in grape harvests.

Craig Stewart, Vice-President, Climate Change and Federal Issues, IBC, says these record breaking weather events are causing insurance affordability to rise and the federal government needs to take more proactive action to mitigate risk.

“Governments need to invest in infrastructure that defends against floods, adopt land-use planning rules that ensure homes are not built on flood plains, facilitate FireSmart in communities in high-risk wildfire zones and implement long-delayed building codes that better protect homes and livelihoods,” says Stewart.